My neighbour Ramesh earns 55,000 rupees a month. His wife, Sunita, handles the home. They have two kids in school. And every single month, by the 25th, they are broke. Not because they are reckless. Not because they eat at fancy restaurants every week. Just because nobody ever sat them down and explained where the money should go.

Does this sound like someone you know? Maybe even yourself?

The truth is, most of us grew up watching our parents stretch every rupee, but nobody really taught us a proper system. We just figured things out as we went. And most of the time, we figured it out the hard way.

This guide is my attempt to change that. If you are a middle-class Indian family trying to get a real grip on your finances in 2026, this one is for you. No jargon. No complicated formulas. Just real talk about how to save money in India when life keeps getting more expensive, and salaries stay the same.

What we have cover!

- 1 The Real Reason Saving Feels Impossible in India

- 2 Build a Budget That You Will Actually Use

- 3 Household Expense Management That Actually Makes a Difference

- 4 Best Budgeting Tips for Indian Families That Go Beyond the Basics

- 5 Reduce Monthly Expenses India Style — Category by Category

- 6 Middle Class Financial Planning India — Think Five Years Ahead

- 7 Your WealthForge Advantage

- 8 Your 2026 Money Action Plan

- 9 Wrapping It Up

The Real Reason Saving Feels Impossible in India

Here is something nobody tells you. Saving is not a math problem. It is a behaviour problem.

Think about it. You know you should save. I know I should save. Everyone knows it. But knowing and doing are two very different things.

For middle-class families in India, there are some very specific pressures that make saving harder than it should be. Inflation hits grocery bills every few months. School fees jump every April without fail. A single hospital visit can wipe out weeks of savings. And then there is the social side of things, weddings, festivals, relatives visiting, and birthday parties. The spending never really stops.

This is why middle-class financial planning in India has to go beyond just writing a budget on paper. It has to account for real life. For the fact that your cousin’s wedding is coming up. For the fact that your AC compressor is going to give up someday. For the fact that your kid will want new shoes before the old ones are actually dead.

Once you understand this, you stop blaming yourself for not saving enough. And you start building a system that works around real life instead of pretending it does not exist.

Build a Budget That You Will Actually Use

I have seen people make the most beautiful budgets. Colour-coded. Categorized. Printed out and stuck on the fridge. Completely abandoned by week two.

The problem with most budgets is that they are too strict. They do not leave room for life. So the moment something unexpected happens, the whole thing falls apart, and people give up entirely.

Here is a better way to think about monthly budget planning, India style.

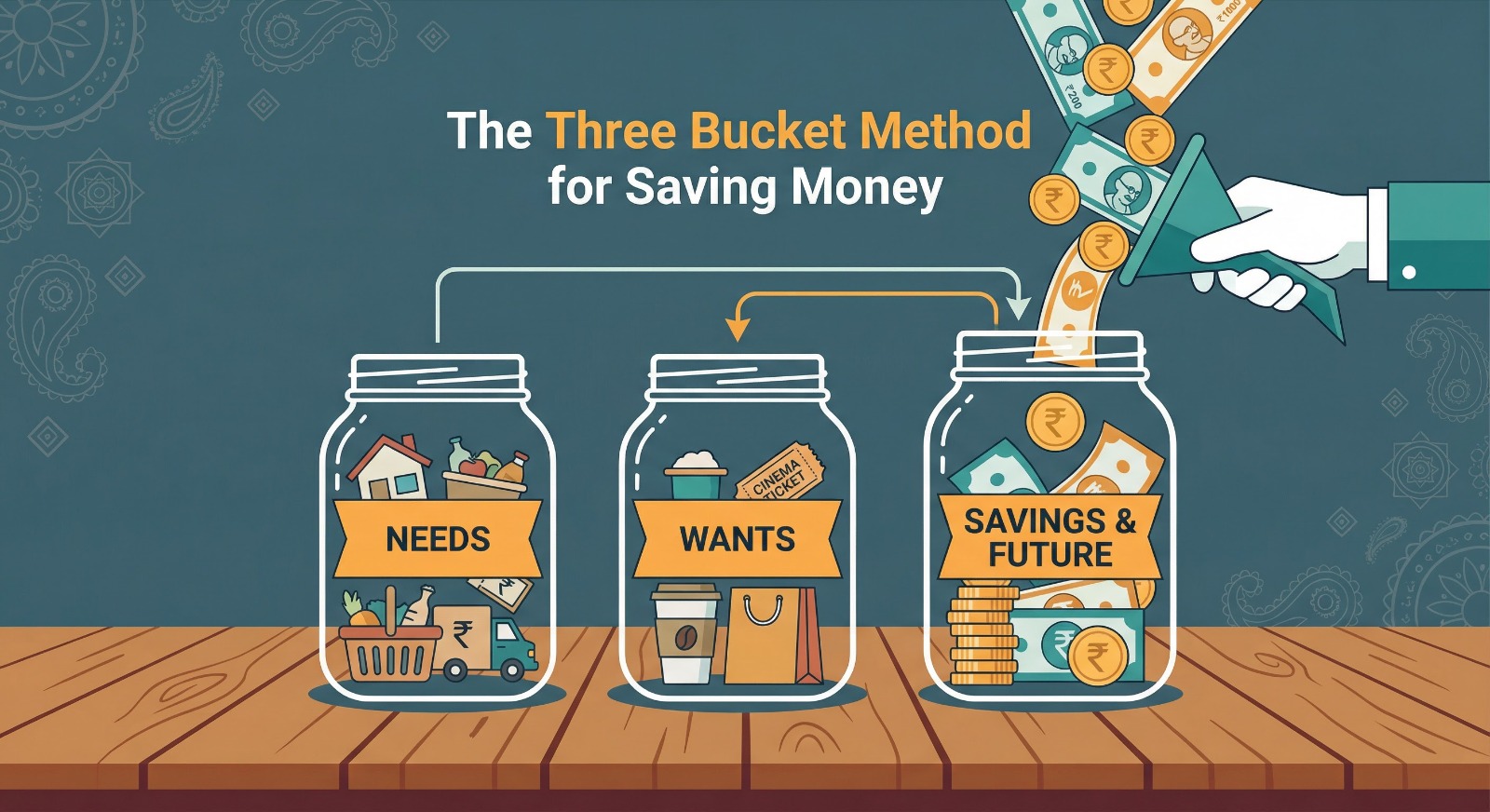

The Simple Three Bucket Method

Forget complicated spreadsheets for now. Just think about three buckets.

The first bucket is for things you cannot avoid. Rent or home loan EMI. Electricity and water bills. School fees. Groceries. Transport to work. These are your non-negotiable expenses. They happen no matter what.

The second bucket is for things you choose to spend on. Eating out. New clothes. Weekend outings. Streaming subscriptions. These are real expenses, and pretending they do not exist is what kills most budgets. They need a dedicated space.

The third bucket is your future bucket. This is savings and investments. The rule here is simple. Fill this bucket first, before the second bucket gets anything.

Most people do it backwards. They spend on needs, then spend on wants, and save whatever is left. The problem is that nothing is ever left. Flip it around. Save first. Then spend on needs. Then allow yourself whatever is left for wants.

This one shift changes everything. It really does.

Know Your Actual Numbers

Sit down this weekend with your last three months of bank statements. Not one month. Three. Because one month can be misleading. Your electricity bill spikes in summer. Festival spending spikes in October and November. A medical bill might have hit in January.

Three months give you a real picture.

Add up everything you spent. Divide by three. That is your real monthly spending. Now compare it to your income. The gap between those two numbers is your actual savings rate. For most Indian families, it is somewhere between zero and five per cent. The goal is to get it to at least 20 per cent.

Household Expense Management That Actually Makes a Difference

Household expense management in India is not about cutting everything and living like a monk. It is about finding the leaks and plugging them.

The Grocery Bill is Hiding Your Savings

For a typical Indian family of four, groceries and food expenses eat up 25 to 35 per cent of the monthly income. That is a big number. And it is also where a lot of smart savings can happen without you feeling deprived at all.

Buy your staples in bulk once a month. Rice, dal, atta, oil, spices. The local kirana store near my house charges 15 per cent less per kilo when I buy a five-kilo bag versus a one-kilo pack. That math adds up fast over a year.

Shop at your local sabzi mandi for vegetables and fruits. I know the supermarket feels cleaner and more convenient. But the price difference is real. You can save 30 to 40 per cent on the same produce just by switching where you shop.

Plan your meals a week in advance. This sounds boring, but it is actually a game-changer. When you know Monday is rajma chawa,l and Tuesday is aloo sabzi with roti, you buy exactly what you need. Nothing extra ends up sitting in the fridge, going bad. Food waste is quietly one of the biggest money drains in Indian homes.

Reduce the monthly expenses Indian families face by simply planning what you eat before you shop for it. It works.

Your Electricity Bill Has More Fat Than You Think

Run an honest experiment this month. Note down your current electricity bill. Then do these things for 30 days and check again.

Switch every bulb in your house to LED if you have not already. An LED bulb uses around 7 watts versus the 60 watts a regular bulb uses. If you have 10 lights running four hours a day, that difference alone can save 300 to 400 rupees a month.

Set your AC to 24 degrees instead of 18. Every degree lower adds roughly 6 per cent to your electricity bill. Run ceiling fans alongside the AC, and you can raise the thermostat by two more degrees without feeling warmer.

Unplug devices when not in use. Your TV set-top box, your phone charger, your microwave. These draw what is called standby power even when switched off. It is not huge individually, but across multiple devices, it adds to your bill quietly.

Fix any dripping taps or running toilets immediately. A leaking tap can waste up to 15,000 litres of water a month. That shows up in your water bill and also in your geyser usage if it is a hot water tap.

Subscriptions Are Eating You Alive

Pull out your phone and go to your bank’s UPI or credit card statement right now. Count how many subscription services are auto-debiting every month. I am willing to bet there are at least two or three you forgot about.

Streaming platforms, music apps, cloud storage, news websites, and fitness apps. They all charge small amounts that feel insignificant. But 299 here and 499 there add up to 2,000 or 3,000 rupees a month easily for many families.

Do a subscription audit every quarter. Keep only what your family actually uses. For the rest, cancel without guilt. You can always resubscribe later when you have a specific reason to.

Best Budgeting Tips for Indian Families That Go Beyond the Basics

There are some habits that consistently show up in families that are doing well financially. These are not secrets. But they require commitment.

Pay Yourself First — Every Single Month

This is the most important financial habit you can build. The day your salary arrives, before you pay any bills or buy anything, transfer your savings amount to a separate account.

Not after paying rent. Not after buying groceries. First. Before anything else.

This is the core idea behind the best budgeting tips for Indian families. When savings sit in the same account as your spending money, they disappear. They get absorbed into daily life without you even noticing. A separate account creates a mental and practical barrier.

Automate this transfer if you can. Set a standing instruction in your bank app for the day after salary credit. Then forget about it. You will adjust your spending to what is left without even trying.

Build Your Emergency Fund Before You Do Anything Else

Before SIPs. Before gold. Before any investment. Build an emergency fund.

This should hold three to six months of your total household expenses. If your family spends 40,000 rupees a month, your emergency fund should be between 1.2 lakh and 2.4 lakh rupees. Keep this in a savings account or a liquid mutual fund where you can access it within 24 hours if needed.

This fund is what stands between you and disaster when the car breaks down, the hospital calls, or the job situation suddenly changes. Without it, any financial emergency becomes a debt emergency. With it, you handle it and move on.

Try the 30 Day Rule for Big Purchases

Here is a simple trick that can save you tens of thousands of rupees a year. Whenever you want to buy something that costs more than 2,000 rupees and is not a necessity, wait 30 days.

Write it down. Set a reminder. Come back to it in a month. Most of the time, you will realise you did not actually want it that badly. The urge passes. And you still have your money.

This works especially well with online shopping. The one-click purchase has made impulse buying way too easy. The 30-day rule puts a speed bump between the want and the wallet.

Reduce Monthly Expenses India Style — Category by Category

Transport Without Burning a Hole in Your Pocket

If you drive a car to work in a city with a good metro or bus system, do the math honestly. Petrol, car loan EMI, insurance, servicing, parking. Put all of it together.

Now compare it to a monthly metro or bus pass. The difference is often 8,000 to 15,000 rupees a month. That is a serious amount of money.

Even switching from a car to a two-wheeler for daily commuting cuts transport costs dramatically. Not for everyone. But worth considering if the numbers make sense for your situation.

For occasional city travel, check whether ride-sharing subscriptions from Ola or Uber offer you better rates than ad hoc bookings.

Health Expenses — Plan Now or Pay a Lot More Later

Medical costs are one of the top three reasons Indian families fall into debt. The prevention here is a good health insurance policy. A family floater cover of 10 lakh rupees costs somewhere between 15,000 and 25,000 rupees per year, depending on your age and family size. That sounds like a lot until one hospitalisation runs you 4 lakh rupees.

Also, use preventive healthcare more actively. Annual health checkups catch things early when they are cheaper and easier to treat. Skipping the checkup to save 2,000 rupees and then paying 2 lakh rupees for a late diagnosis is not good math.

Children’s Education Does Not Have to Break You

School fees, tuition, activity classes, stationery, uniforms, and education costs can easily hit 10,000 to 30,000 rupees or more per month for urban families.

Look into scholarships actively. Many schools and state governments offer them, but parents assume they either do not qualify or do not bother to apply. Both are costly assumptions.

For tuition, a well-reviewed local teacher often delivers results comparable to a branded coaching centre at 40 to 50 per cent of the cost. Ask other parents in your colony for recommendations before signing up for the most advertised option.

Buy second-hand textbooks from students a year or two ahead. The condition is usually good, and the savings are significant.

Middle Class Financial Planning India — Think Five Years Ahead

Saving money is step one. Making that money grow is step two. And this is where most middle-class families in India stop short.

Start a SIP Even If It Is Small

A Systematic Investment Plan in a mutual fund is the most practical investment tool available to a regular Indian family. You can start with 500 rupees a month. It goes up automatically as you earn more. And over 10 or 15 years, even modest amounts turn into meaningful wealth through the power of compounding.

According to SEBI’s official investor education platform, disciplined long-term SIP investing has consistently helped retail investors build wealth that beats inflation over time. That is not marketing. That is decades of data.

Index funds are the best starting point for beginners. Low cost. Transparent. No fund manager risk. Just the market doing what it does over time.

PPF and NPS Are Your Best Friends for Tax Saving

The Public Provident Fund gives you a government-backed guaranteed return that is completely tax-free. The lock-in period is 15 years, which forces you to leave the money alone and let it compound. You can invest up to 1.5 lakh rupees per year and claim the full amount as a deduction under Section 80C.

The National Pension Scheme gives you an additional deduction of 50,000 rupees beyond the 80C limit under Section 80CCD. And it builds your retirement corpus automatically through a mix of equity and debt.

These two tools together can reduce your tax outgo significantly while building long-term wealth. Most middle-class families underuse them simply because they do not know enough about them.

Stay Away From Debt That Costs You

Personal loans and credit card interest rates in India range from 18 to 42 per cent per year. That is not a typo. That is the cost of borrowing money casually.

If you carry a credit card balance, paying it off is the single highest return investment you can make. Clearing a 36 per cent interest rate debt is equivalent to earning 36 per cent guaranteed returns. No market investment can reliably do that.

Use credit cards only if you will pay the full outstanding amount every month. Not the minimum due. The full amount. The minimum due trap is how people spend years paying for a holiday they took in 2019.

Your WealthForge Advantage

All the tips in this article are a solid foundation. But learning does not stop here.

WealthForge is built specifically for Indian families who want to take their finances seriously. From practical budgeting guides to investment calculators to plain language explanations of tax saving tools, WealthForge gives you everything you need to move from surviving month to month to actually building something meaningful for your family.

The content at wealthforge.live is designed around real Indian income levels, real Indian expenses, and real Indian financial goals. Not American personal finance repackaged with a rupee sign.

If you found this article useful, you will find a lot more waiting for you there.

Your 2026 Money Action Plan

Here is where to begin this week. Not next month. This week.

Look at your last three bank statements and find out your real monthly spending. Identify two or three subscriptions you can cancel immediately. Set up an automatic transfer to a separate savings account on salary day. Open a PPF account if you do not have one. Start a SIP of whatever amount you can manage right now and increase it later. Apply the 30-day rule to the next three non-essential purchases you feel tempted to make.

That is it. Six actions. Start there.

Wrapping It Up

How to save money in India as a middle-class family in 2026 comes down to one thing more than anything else. Intention. Deciding that your financial future matters enough to pay attention to it.

You do not need a high salary. You do not need to stop enjoying life. You just need a system that works for the real version of your life, with all its festivals and medical bills and school fees and surprises.

The families that build real financial security in India are not the ones who earn the most. They are the ones who made a decision at some point to stop letting money just happen to them. And started happening to their money instead.

That decision is available to you right now. Today. Not on the first of next month.

Start today.